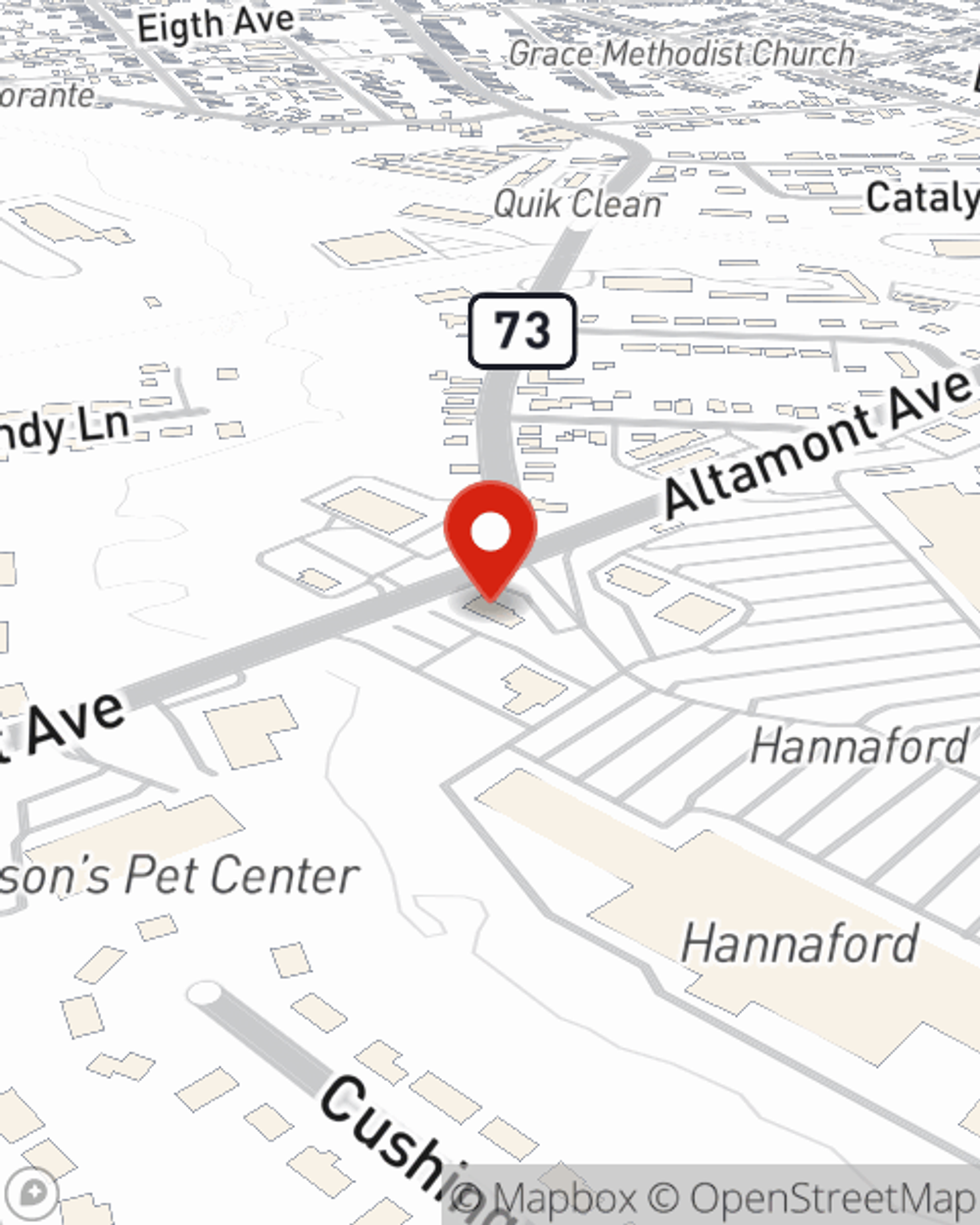

Renters Insurance in and around Schenectady

Looking for renters insurance in Schenectady?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Think about all the stuff you own, from your bookshelf to bed to kitchen utensils to silverware. It adds up! These valuables could need protection too. For renters insurance with State Farm, you've come to the right place.

Looking for renters insurance in Schenectady?

Coverage for what's yours, in your rented home

Safeguard Your Personal Assets

When renting makes the most sense for you, State Farm can help insure what you do own. State Farm agent Shirley Martinez can help you create a policy for when the unexpected, like an accident or a fire, affects your personal belongings.

There's no better time than the present! Reach out to Shirley Martinez's office today to get started on building a policy that works for you.

Have More Questions About Renters Insurance?

Call Shirley at (518) 355-5606 or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Shirley Martinez

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.